In part one of this series, I talked about how to understand polyester pricing swings and why rising costs and a dynamic market has thrust the industry into a volatile time. In part two, I touched on understanding market, spot and indexed pricing. In this post, I’ll focus on index formulas, particularly once a supplier and client decide to index a price, what does it look like? In general, designing a simple index formula is the best strategy. The difficult part is agreeing to the finer details up front. Both parties must carefully consider the following aspects.

In part one of this series, I talked about how to understand polyester pricing swings and why rising costs and a dynamic market has thrust the industry into a volatile time. In part two, I touched on understanding market, spot and indexed pricing. In this post, I’ll focus on index formulas, particularly once a supplier and client decide to index a price, what does it look like? In general, designing a simple index formula is the best strategy. The difficult part is agreeing to the finer details up front. Both parties must carefully consider the following aspects.

- Duration of the agreement

- Components of the formula

- Set point

- Frequency of price changes

Duration of the agreement:

Duration of the agreement is an important aspect. Some are perpetual or “evergreen” with an option to modify or cancel if given enough notice by either party. Others have hard stop dates or re-evaluation intervals. If an evergreen is agreed upon, it is wise to clearly define escape clauses for both parties.

Regardless of the exact duration, these agreements need to be reviewed periodically to ensure that they are mutually beneficial and truly indicative of market and cost realities.

Components of the formula:

A typical simple formula is as follows:

(0.35 x MEG) + (0.86 x PTA) = Index Price

MEG is Ethylene glycol and PTA is Purified terephthalic acid, the two input commodity materials for polyester yarn manufacturers that have the biggest impact on costs.

You might notice that adding 0.35 to 0.86 equals 1.21 – this accounts for raw materials consumed during the manufacturing process through evaporation and chemical reactions.

While exact formula numbers can vary slightly (ie. 0.865 for PTA or 0.335 for MEG) they're typically all within a close range. Professional market research companies like IHS and PCI/Wood Mackenzie are well known and respected in our industry for supplying the commodity prices of petrochemicals in various regions of the world, including MEG and PTA.

Some companies include additional fluctuations, including currency exchange rates, ocean freight, energy, inland freight. This makes for a complex formula so most agreements focus on MEG and PTA.

Set Point:

Qualifications can take months or years. Market dynamics will certainly be different 12 or 18 months from the beginning of a development to inception. So when a program is ready for commercialization, both parties must agree on the starting price or set point. This is simpler said than done as set points don’t always align with current spot pricing.

Each party must be willing to agree to a fair and reasonable set point. This is usually determined by evaluating spot pricing trends and acceptable ongoing margins (or savings from the viewpoint of the customer). Where is the spot price today, where was it six months ago and what do we forecast it to be six months from now? Forecasting is a very difficult exercise and everyone must remember that a forecast is just that: a forecast, an educated guess. Sometimes you’re right and sometimes you’re way off.

Regardless, if each party is satisfied with the set point, index pricing can be a huge benefit to everyone involved. It makes pricing negotiations easy (OK, easier-they’re never easy!) and gives some predictability to an ever-changing cost component. For industries where polyester yarn is 60% or more of the total product cost, stability and volatility mitigation are key risk reduction and cost control strategies.

Frequency of Price Changes:

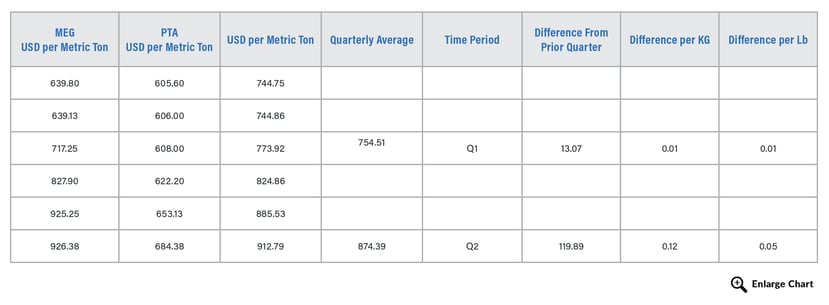

Typically, indexed prices change every quarter. The prior quarter numbers are plugged into the formula and the change is implemented. Example as follows:

In this example, pricing would have increased $0.05/lb. from Q1 to Q2. Some agreements limit the frequency of change to twice a year or even once per year. However, everything is negotiable.

Other Considerations:

Volume consistency and stability are crucial for the supplier and the customer when using an indexed price. Stable, smooth volumes make it fair for both parties. For instance, let’s assume that you operate with quarterly price changes. Theoretically, the supplier bills a 6 month supply within Q1, assuming the price change mentioned above. During Q2, nothing is billed. The supplier loses because the price increase for Q2 was unrealized. If the price had declined, the customer would lose because they would not have realized the savings.

Market research companies report Asia, Northeast Asia, West Europe, North America and China costing. Contract and spot prices are both reported. Given the current concentration of polyester capacity in China, Northeast Asia numbers are primarily utilized. The region where the polyester is produced should be used as various regions can differ significantly.

Many variables must be considered when entering into an indexed pricing contract. The negotiation process can be very time consuming but, at the end of the day, it will be much less time consuming on an annual basis. Confrontations can be avoided and some sense of predictability can be injected into a very dynamic landscape.

Torry Losch is Sales Director at Hailide America and guest blog post writer for Service Thread. Torry has 21 years of experience in the textile industry and is viewed as a mechanical rubber goods and technical fiber / yarn expert.